DeFi added immense values to blockchain technology, cryptocurrencies and the global finance. It provided many ways for crypto users to earn passive income from any part of the world. It also provided an easy ways for people to get loans even without having any physical collateral as demanded by traditional financial institutions like banks. In this article, you will learn all about DeFi and how it works, ways to make money from DeFi and some risks involved, etc.

What is DeFi?

DeFi as an acronym means Decentralized Finance. It is a global, open financial system with an open source technology, an alternative to the old-fashioned and tightly-controlled financial system. DeFi products allow you to borrow, lend, save, invest, trade and do lot more.

With DeFi, you have full access and control of your money, giving you more exposure to the global market. Also, this financial system is open for use 24/7 so long as you are connected to the internet, unlike your local banking system, where you are restricted to use it at certain hours or even some days. So far, cryptocurrencies worth billions of dollars have flowed through DeFi apps, and the system keeps growing day by day.

A Brief History of DeFi

The history of DeFi can be traced back to Bitcoin, the first blockchain network that allows you to own, control and send your funds around the world without relying on any third-party or intermediary. Although Bitcoin is open to anyone to use, but no one can change its rules, unlike the traditional financial systems where governments can easily put up any policy, which can change the way the traditional finance works.

Ethereum now took over DeFi from Bitcoin and enhanced the system. With the introduction of smart contracts, digital money went beyond being used as store of value and became programmable. Anyone can now program logic into payments and this has made it possible for you to do almost anything with cryptocurrencies.

How does DeFi Work?

In the traditional financial system, financial institutions act as intermediaries or guarantors of different transactions. This role that financial institutions play in the traditional finance gives them much authority over your funds as they will have to approve any transaction you make before it can go through. Thus the traditional finance is said to be centralized, because it is controlled by a central body (financial institutions and government). Many people who don’t have bank account or the required collateral for certain loans are denied access to these funds.

This is why DeFi came in, to transform the financial system and make it available for anyone with internet connection in any part of the world. So in DeFi, smart contracts replace the financial institution in any transaction. These smart contracts are a type of Ethereum account designed to hold funds, and also capable of sending or refunding these funds automatically, once some pre-set criteria are met. One of the advantages of these smart contracts is that once they are live, no one can alter them and they run as programmed.

For example, a smart contract programmed to pay a specified group of workers their salaries from an account (say Account A) at every last Friday of every month will do that effectively, so long as there is always enough fund in account A. No one can alter the list of workers or even change the amount pre-specified to pay each worker in the smart contract. Moreover, codes of smart contract are public (open source) for anyone to inspect and audit. There are no limit to the tasks that smart contracts can be programmed to do.

How Ethereum Transformed DeFi

Ethereum has completely decentralized DeFi, since no one owns the Ethereum network or the smart contracts that power DeFi. This has made DeFi open for anyone to use. Also, many of the DeFi products work together seamlessly, because they speak the same language behind the scene, which is Ethereum. You can easily interact with and use as many Defi products as needed.

Above all, you have full control of your money, and can also track any transaction that occurred in the Ethereum network.

To better understand how Ethereum has transformed DeFi, see DeFi as a four-layer system:

- Layer 1: The Blockchain – which is the Ethereum network that stores transaction history and transaction IDs.

- Layer 2: The Asset – which is Ether (ETH) or any other cryptocurrency used in carrying out the transactions.

- Layer 3: The Protocols – which are the smart contracts that provide all the needed decentralized functionalities.

- Layer 4: The Applications – which are the products or applications that connect you to the protocols, and also allows you to use and manage the protocols.

Note: There are also aggregator applications who connect you to various existing DeFi applications to provide a special service to investors. For example, when lending you funds to a pool, you might need another app to help you located the best pool to lend your funds in order to earn higher returns.

Check:

- All About Ethereum and Its Future: Complete Guide

- Web3 Job Categories, Resume Guide & Tips for Beginners

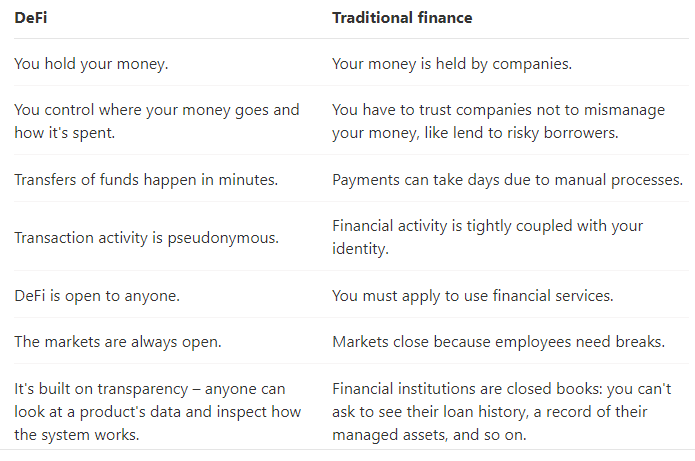

DeFi vs Traditional Finance (TradFi)

In order to appreciate Decentralized Finance (DeFi), you need to compare it with traditional finance (TradFi). The screenshot below contains a comparison between DeFi and traditional finance.

You can learn more about DeFi from this article.

What can you do with DeFi?

There are tons of things you can achieve with Decentralized Finance. Some of these things include:

- Sending and streaming money around the world

- Borrowing money with or without collateral

- Access to trusted and affordable insurance

- Easy access to stable currencies

- Trading, managing and saving different cryptocurrencies

- Easy access to flash loans (loans that are borrowed and paid back almost instantly)

- Lending your cryptocurrencies at reasonable interest rates

- Easy access to liquidity mining or yield farming (the process of lending your crypto assets to a participant pool in exchange for a rate of return in the form of new coins or tokens)

- Participating in decentralized derivatives (peer-to-peer exchange of cryptocurrencies on decentralized exchanges).

Other transaction opportunities created by DeFi are being discovered day by day.

Some of the Risks Associated with DeFi

Just like any other system, DeFi is not just a bed of roses, there are also many risks and threats involved which you should be aware of. Below are some of them.

Rug Pull

A situation where project teams abandon the project and disappear with investors’ funds. Many top investors have been victims of rug pulls. That is why you need to do proper research about a project before you invest in it.

Smart Contracts Failure or Crash

Smart contracts are made up of codes and a set of rules. Although they are carefully audited before they go live, but sometimes they fail or crash for some unforeseen reasons. For example, an incorrect input can make a smart contract to crash or even a bug in the code that was not spotted before the smart contract went live can also cause it to fail.

Protocol Hack and Flash Loan Attack

A protocol hack is when malicious hackers identifies a loophole in the smart contract of a project and then drain the funds there.

Flash loan attack is when malicious hackers takes a flash load from a DeFi lending protocol and then use the borrowed funds to manipulate the market in their favour and then pay back the loan, and then hold back the interest. Flash loan attacks are one of the most common types of DeFi attacks and account for hundreds of millions of dollar losses in DeFi.

Generally, the risks encountered in DeFi can be classified into 3:

- Financial Risks

- Procedural Risks

- Technical Risks

Financial risks affects the potential rewards of an investment opportunity and can be attributed to the organization or the risk tolerance of the investor.

Procedural risks directly relates to the DeFi users and the way they use the DeFi products, which may compromise security.

While technical risks relates to issues pertaining to protocols, hardware and software of DeFi products and services.

As DeFi is being developed, some of these risks are taken care of, and more risks emerge because of its decentralized nature. As a smart investor, you need to be fully aware of these risks and then seek for solutions and how to avoid falling victim to these threats.

How to Deal with these DeFi Risks

Here are some of the recommendations and best practices which can help you avoid these DeFi risks.

- Always choose trusted DeFi products and services.

- Activate multi-factor authentications for all your DeFi apps.

- Update your DeFi apps regularly to avoid falling prey to some security loopholes which the developers of the apps have corrected in the latest versions of the apps.

- Never publicize your digital assets for any reason, so that you don’t call the attention of malicious hackers.

Different Ways to Make Money from DeFi

DeFi has not only transformed the way global financial system works, it has also provided different opportunities through which its users can earn passive income without much risk. One of the advantages of DeFi earning opportunities is that they are not as resource-intensive and technical as cryptocurrency mining. Thus anyone, including those who are new to cryptocurrencies can benefit from these earning opportunities. Generally, these DeFi earning opportunities simply involves committing a part or whole of your cryptp assets into fairly-safe decentralized protocols, which are locked in special smart contracts, most times for a specific period of time. In return, you earn interest or incentives, which are far better than what your local banks offer.

Note that these DeFi earning opportunities are not get-rich-quick or risk-free schemes. They require patience and careful considerations when choosing a good and reputable protocol to invest in. Also, before you can benefit from these DeFi earning opportunities, you need to know how to use Web3 digital asset wallets like MetaMask, Trust Wallets, etc. and how to interact with different cryptocurrency networks. In this section, you will learn some of the lucrative ways to earn passive income in DeFi, which are less risky than trading cryptocurrencies.

Staking

Staking is simply the process of locking a token into a smart contract, in return you earn more of that same token. The staked token is usually the native token of the blockchain network. For example, for Ethereum 2.0, the token to stake is Ether (ETH). The rationale behind the token incentives is that block chain networks that use Proof-of-Stake consensus mechanism use the assets locked in smart contracts to secure and run the network. Validators help to ensure that the rules of the network are upheld and that none of the blockchain users succeeds in cheating the network.

These validators also stake their tokens in order to secure the network. The more token a validator owns and stakes, the more the vote of the validator counts. For example, before you can be a validator in Ethereum 2.0, you must stake at least 32 ETH, although some platforms use a pooling mechanism where users can stake a lesser amount and still benefit from the staking rewards.

Once you stake your tokens, the PoS mechanism takes care of the rest. But you can manually claim your rewards once in a while.

Some Decentralized Exchanges (DEXs) with their Automatic Market Maker (AMM) models offer their users the option to stake their native tokens and earn a share of the revenue generated by all their products and services. Some of these DEXs include: Uniswap (UNI), Pancakeswap (CAKE), Plasma Finance (PPAY), etc.

Providing Liquidity (Liquidity Mining)

Most popular DEXs like Uniswap, SushiSwap, Yearn, Pancakeswap, etc. use the automatic market maker (AMM) protocol in place of the order books mostly used by centralized exchanges. The basis for the trading markets on these DEXs are liquidity pools, which are made up of equal values of token pairs. Since these liquidity pools are public, anyone can provide liquidity to these pools by locking equal values of some specific token pairs like ETH-USDT, ETH-DAI, etc.

For example, if you wish to provide liquidity of $5000 in the ETH-USDT pool, you will provide $2500 worth of ETH and $2500 worth of USDT. Once you lock up these assets in the pool, you will receive a liquidity provider (LP) token which represents your share of the total liquidity pool. As a liquidity provider, you earn a share of the swap fee for that trade pair, for example ETH/USDT proportional to your contribution to the pool. For example, if you provide liquidity in Uniswap, you will a share from the 0.3% swap fee that the DEX charges its users.

If you wish to remove your share in the pool, the LP token will be taken back, and then your initially contributed assets will be returned to your wallet in the same ratio, plus the share of the fees you have earned. In order to maximize your profits from providing liquidity, utilize some LP aggregators that provide real-time data which can help you estimate your returns from various liquidity pools. Other aggregators offer cross-chain integrations and multiple wallet connections, which makes simultaneous, real-time, charting and data analysis from different aggregators very easy. Some of these staking aggregators include: Zapper.fi, Zerion.io, App.1inch.io, Plasma.finance, etc.

Note that some liquidity pairs have higher APY (Annual Percentage Yield) than others, but the effect of Impermanent Loss (IL) is also higher for them. This impermanent loss occurs as a result of the high price volatility associated with cryptocurrencies. The price volatility is least for stable coins. So to reduce the risk of impermanent loss as liquidity provider, choose pools that are highly liquid or liquidity pairs that are made up of less volatile cryptocurrencies like stable coins.

Yield Farming

With yield farming, you earn an extra income from your LP tokens. Recall, when you provide liquidity in a DEX like Uniswap, you will receive a liquidity provider (LP) token. This LP token can be locked in another DeFi protocol, called yield farm, where you are rewarded with more of the same LP token or with a different token.

So, yield farming is simply putting your LP tokens to work (locking them) in order to earn an extra reward. This means you now have two sources of income; one from the liquidity pool protocol and the second from the yield farm protocol.

NOTE: Be very careful when choosing a yield farm protocol to lock your LP tokens because malicious developers of some yield farm protocols can “rug pull” your LP tokens and then use them to your liquidity from the DEX pools. Always choose yield farm platforms that have good reputation and have externally audited smart contracts.

Lending

Lending is one of the first DeFi earning opportunities where you lend your digital assets to a lending platform by locking the assets in their smart contract. Those who borrow these assets from the platform pay back with interest. The smart contract now distributes a portion of the interests generated from the locked assets to the lenders, according to the amount each lender locked.

Some of these lending platforms like Compound.finance pay reasonable APYs, up to 8.1%, which are higher than what you can earn from locking your assets with any traditional financial institutions. In order to reduce the risk of borrowers defaulting loans, the platform ensures that these borrowers lock up collateral which can cover both the capital and its interest in case the borrower defaults. These collaterals are bound by smart contracts.

See:

- Cryptocurrency Staking (PoS) Guide for Beginners

- Complete Blockchain Career Guide & Job Opportunities

Conclusion

DeFi is constantly gaining traction globally because of its impact and contribution in the global finance. Other DeFi earning opportunities with lesser risks will emerge in future. This means its users can have multiple channels of passive income which are less risky than trading cryptocurrencies.

Follow us on social media