Here is a 10-in-1 calculator app that comprises of the following calculators: Mortgage Calculator, Interest Calculator, Equated Monthly Installment (EMI) Calculator, Term Deposit Calculator, Recurring Deposit (RD) Calculator, Stock Calculator, Yield to Maturity (YTM) Calculator, Bond Price Calculator, Annuity Deposit Calculator and Real Rate of Return Calculator. You will also learn how to use each calculator.

Best Free 10-in-1 Online Financial Calculator App

Features of the Free 10-in-1 Online Financial Calculator App | How it Works

Below are some unique features of the free 10-in-1 online financial calculator app and how to use it:

User-Friendly and Responsive Interface

The app has a very user-friendly and responsive interface that can be used on any device, both mobile and PC. Also it is very interactive. So any online user can use it easily.

10 Powerful Financial Calculators in One App

Access the following financial calculators in one app: Mortgage Calculator, Interest Calculator, EMI Calculator, Term Deposit Calculator, Recurring Deposit (RD) Calculator, Stock Calculator, YTM Calculator, Bonds Calculator, Annuity Deposit Calculator and Real Rate of Return Calculator.

All you need to do is to tap the change Widget link to see all the 10 financial calculators in the app. Then tap on the calculator you wish to use, and provide the details required b the calculator.

After performing your first calculation on any of these calculators, before you perform another calculation, press the Reset button.

Check:

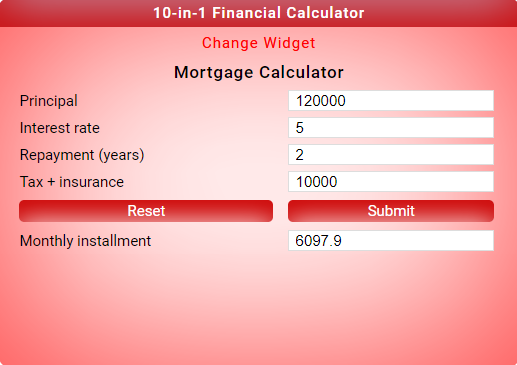

Mortgage Calculator

You can use a mortgage calculator as a consumer to calculate the monthly installment you have to pay in other to pay off a mortgage, considering the annual interest rate, tax and insurance cost involved. Mortgage providers use a mortgage calculator to determine whether a home loan applicant will be able to pay off the mortgage, based the the applicant’s financial suitability, by comparing the loan applicant’s total monthly income and total monthly debt load.

Make sure you use a mortgage calculator to check if your monthly income will be able to pay off a mortgage within the specified payment period, and also considering the interest rate, tax and insurance cost associated with the mortgage before you take it.

For our mortgage calculator, you are required to provide the following details:

- Principal: Which is the amount of the mortgage you took or are about to take.

- Interest rate: The annual interest rate of the mortgage.

- Repayment (years): The period (number of years) the mortgage provider gives you to pay off the mortgage (by making a monthly installment), including its interest, tax and insurance cost. It is simply the tenure of the mortgage.

- Tax + Insurance: Which is the sum of the tax and insurance cost associated with the mortgage or loan.

After providing these required details in the calculator, tap the Submit button. The mortgage calculator will calculate the monthly installment that will clear off the mortgage and other costs associated with it.

EMI Calculator

EMI stands for Equated Monthly Installment. It is usually associated with personal loans. An EMI calculator calculates the periodic, equal amount that you should pay in order to off set a personal loan with the tenure of the loan.

For our EMI calculator, you are required to provide the following details:

- Loan Amount: Which is the amount you borrowed.

- Loan Term (months): Which is the tenure of the loan.

- Interest Rate: Which is the interest rate associated with the load.

After providing these required details in the calculator, tap the Submit button. Then the EMI calculator will calculate the equal, periodic amount (EMI), the total interest (Intt. payable) associated with the loan. The EMI calculator will also calculate the total amount (total payable) you would have payed at the end of the loan tenure.

Interest Calculator

The interest calculator calculates the extra amount your investment capital or your loan (as the case may be) will yield at the end of a specific period, depending on the investment or loan amount (principal), interest rate (usually expressed in percentage), tenure (total period) of the investment or loan.

The two main types of interest are Simple Interest and Compound Interest. For simple interest, the interest amount is calculated annually from the amount (principal) you invested or borrowed. But for compound interest, the total interest amount depends on both the original amount (principal) you invested or borrowed and the accumulated interest from the previous periods.

Banks and other financial institutions which offer loans to their customers calculate their interest from such loan on compound basis. For the lender, compound interest is a plus. But for the borrower, it is a minus. Investments that allow compounding of interests yield more profits for the investors than the ones that implement simple interest method.

For our interest calculator, you are required to provide the following details:

- Principal: Which is the amount invested or borrowed.

- Interest rate: The interest rate offered by the investment or lending platform.

- Period in months: The tenure of the investment or loan.

- Interest Type: Simple or Compound.

- Compounding: Which is the compounding frequency of the investment or loan. You have 4 options here: Monthly, Quarterly, Half-yearly and Yearly. But most investment and lending platform offer interests that compounds at a yearly frequency.

After providing these required details in the calculator, tap the Submit button. Then the interest calculator will calculate the interest amount.

Term Deposit Calculator

The term deposit calculator calculates the total amount your principal will grow to in a term deposit account, depending on parameters like initial amount you deposited, interest rate, interest frequency and investment tenure (period or duration).

For our term deposit calculator, you are required to provide the following details:

- Principal: Which is the amount invested.

- Interest rate: The interest rate offered by the investment platform or bank.

- Interest Frequency: You have 4 options here: Monthly, Quarterly, Half-yearly and Yearly. But most investment platforms offer a yearly compounding interest.

- Period in months: The tenure (duration) of the investment (in months).

After providing these required details in the calculator, tap the Submit button. Then the term deposit calculator will calculate the maturity value of your investment capital.

Recurring Deposit (RD) Calculator

Recurring deposit (RD) calculator calculates the maturity value of your recurring deposit account, depending on the amount you deposit monthly, interest rate and duration (tenure) of the investment.

For our recurring deposit calculator, you are required to provide the following details:

- Monthly: Which is the amount you deposit monthly into your RD account.

- Interest rate: The interest rate offered by the investment platform or bank.

- Interest Frequency: You have 4 options here: Monthly, Quarterly, Half-yearly and Yearly. But most investment platforms and banks offer a yearly compounding interest.

- Period in months: The tenure (duration) of the investment (in months).

After providing these required details in the calculator, tap the Submit button. Then the recurring deposit (RD) calculator will calculate the maturity value of your monthly deposits.

Stock Calculator

A stock calculator calculates your return on investment and annualized return on stocks you bought based on the number of the stock/share bought, price purchased per stock/share, date purchased, price purchased per stock/share and date sold.

Stock vs Share vs Bond

Stocks, shares and bonds are related, but they have some distinctions. A stock is a type of investment that gives the investors/stockholders a share of ownership in a specific company. It can also be referred to as equities. A share is the smallest denomination of a specific company’s stock. You buy stocks with the hope that its worth or price will grow with time, so that you can later sell them for profit in a stock market. While a bond is a loan from private investors to a company or government. Unlike stocks, bonds pay fixed interest over time.

For our stock calculator, you are required to provide the following details:

- Number of scrips: The number of stocks of a company you bought.

- Purchased on: The date of purchase of the stock.

- Sold on: The date you sold off the stock.

- Purchase price per scrip: The price you bought each stock.

- Sale price per scrip: The price you sold each stock.

After providing these required details in the calculator, tap the Submit button. Then the stock calculator will calculate the return on investment (ROI) of the stock and also calculate the annualized return (in percentage) for the stock.

See:

- 5 Best Online Stock Trading Apps for Mobile Devices

- 5 Best Ways to Make Money from Solar Energy Sector

YTM Calculator

YTM means Yield to Maturity. YTM is also called Redemption Yield or Book Yield. Yield to Maturity (YTM) is the internal rate of return (IRR) of a bond investment if the investor holds the bond until it fully matures, assuming all the payments were made as scheduled and reinvested at the same rate. The YTM calculator calculates the total returns you will get by buying and holding a bond till it matures.

For our Yield to Maturity (YTM) calculator, you are required to provide the following details:

- Par value: Which is the face value of the bond.

- Market value: Which is the current price on the bond.

- Coupon rate or Interest rate: The fixed value of the interest you as a bondholder will receive, usually expressed in percentage of the bond’s face value.

- Coupon payment frequency: The established interest payment interval for the bond or simply the number of times the coupon was distributed in a year.

- Months till maturity: The number of year it will take the bond to fully mature.

After providing these required details in the calculator, tap the Submit button. Then the YTM calculator will calculate total yield of the bond, the YTM and the annualized yield in amount and in percentage.

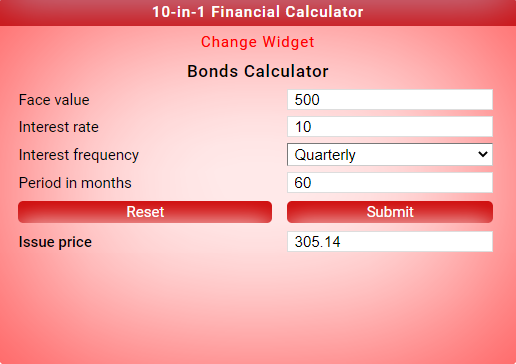

Bond Calculator

The bond calculator is used to calculate the price at which the bond was issued out by the government or company.

For our bond calculator, you are required to provide the following details:

- Face value: Which is the par value of the bond.

- Interest rate or coupon rate: The fixed value of the interest you as a bondholder will receive, usually expressed in percentage of the bond’s face value.

- Coupon payment frequency: The established interest payment interval for the bond or simply the number of times the coupon was distributed in a year.

- Period in months: The full maturity period of the bond in months.

After providing these required details in the calculator, tap the Submit button. Then the bond price calculator will calculate the issue price of the bond.

Annuity Deposit Calculator

An annuity is a contract between you and an insurance company, whereby you deposit a lump-sum of money or series of payment, in return your receive regular income immediately or in the future that will off set the initially deposited lump-sum, with interest for you. One of the main goals of annuity is to provide a regular stream of income, especially for retired workers. Also note that annuities fall into 3 main categories: fixed, indexed and variable, each having its own level of risk and payout potential.

The annuity deposit calculator calculates the periodic amount that will pay off a lump sum of money money deposited, which is affected by the interest rate and the duration of the annuity.

For our annuity deposit calculator, you are required to provide the following details:

- Lump sum deposit: The total sum you deposited either once or in series of deposits.

- Interest rate: The annuity interest rate in percentage.

- Period in months: The duration of the annuity contract or period of the annuity in months.

- Annuity payment frequency: Either in monthly or quarterly.

After providing these required details in the calculator, tap the Submit button. Then the annuity deposit calculator will calculate the periodic annuity amount.

Real Rate of Return Calculator

Real rate of return is the actual annual rate of return on an investment, taking into considerations, factors that affect the purchasing power of a given amount of money over time. Some of these factors include: inflation, taxes and even investing fees.

The real rate of return calculator calculates the actual rate of return or the actual value of the annual percentage profit on an investment amount, which depends on the interest rate, duration of the investment and inflation rate.

For our real rate of return calculator, you are required to provide the following details:

- Investment amount

- Interest rate

- Interest compounding frequency: You have 4 options here – Monthly, Quarterly, Half-yearly and Yearly. But most investment platforms offer a yearly compounding interest.

- Period in months: The duration of the investment in months.

- Inflation rate: The yearly inflation rate.

After providing these required details in the calculator, tap the Submit button. Then the real rate of return calculator will calculate the real rate of return.

Check:

Conclusion

You have learnt all about our 10-in-1 financial calculator app, all about the following calculators: Mortgage Calculator, Interest Calculator, EMI Calculator, Term Deposit Calculator, Recurring Deposit (RD) Calculator, Stock Calculator, YTM Calculator, Bond Price Calculator, Annuity Deposit Calculator and Real Rate of Return Calculator, and how to use them. Feel free to use the app.

Do you need a professional company logo? Check out these Top 7 Best Tools to Make your Business Logo.

Did you find any section of this article confusing? I will like to hear it in the comment section below. Don’t forget to subscribe to our blog via email to get notified when we launch new web tools, apps and articles. Help your social media friends to know about this tutorial article by clicking a share button below. Enjoy!