Staking is one of the ways of earning passive income in blockchain technology, made possible by Proof of Stake (PoS) consensus mechanism. DeFi (Decentralized Finance) then improved staking and made it more lucrative. It is always good to first check the estimated staking rewards you will get from a staking platform before committing/staking your tokens. Here is a simple, but powerful calculator app for calculating your staking rewards from any staking platform.

Staking Rewards Calculator App for any Coin or Staking Platform

Features of the Staking Rewards Calculator & How it Works

Below are some unique features of the calculator app and how to use it:

User-Friendly and Responsive Interface

The calculator has a very user-friendly and responsive interface that can be used on any device, both mobile and PC. Also, it is very interactive. So any trader can use it easily, even newbie crypto traders.

Can be Used to Estimate Staking Rewards for any Staking Platform

You can use this calculator to calculate the staking rewards in any staking platform.

All you need to do is to first take note of the APY the staking platform offers for the coin you wish to stake, and the allowed staking period. Most times, the APY varies directly with the staking period. Also, APY offered for any coin tend to decrease as more stakers stake the coin in a particular staking platform.

Next, enter the name of the coin you wish to stake in the appropriate field in the app.

Now, enter the principal amount of the coin you staked or wish to stake.

Also, enter the staking period/duration (in days).

Then, press the Calculate button as shown in the screenshot below.

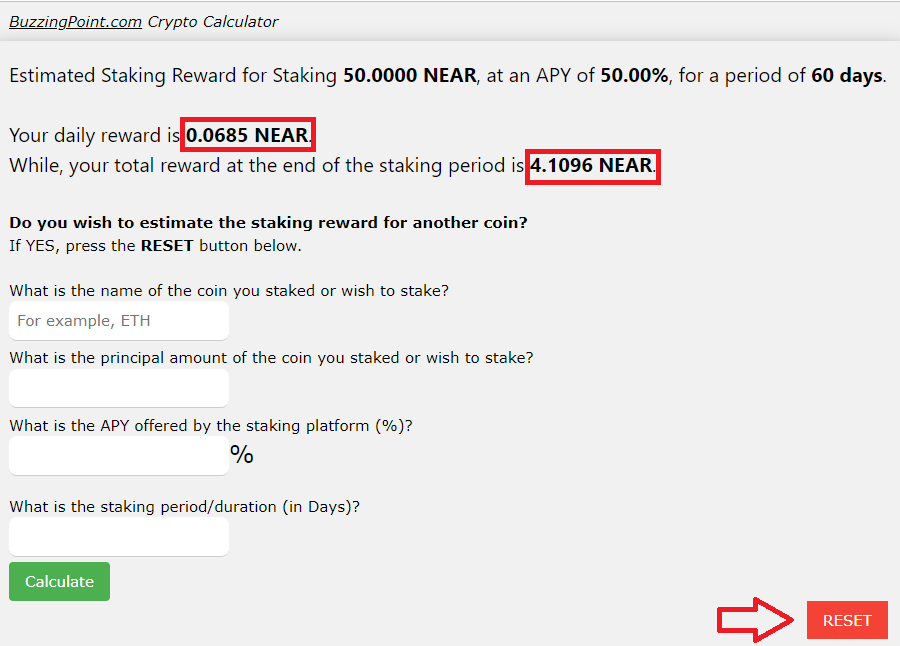

Shows you both your Daily and Total Staking Rewards

This staking rewards calculator calculates and displays both your daily staking rewards and the total rewards you will earn at the end of the staking period.

When you click the Calculate button, the staking rewards calculator app calculate your staking rewards, based on the staking details you specified. Then it will show you your daily rewards and the your total rewards at the end of the specified staking period, as shown in the screenshot below.

If you wish to calculate the staking rewards of another coin, then press the RESET button as shown in the screenshot above.

See:

What is Staking?

Staking is an activity associated with the Proof of Stake (PoS) consensus algorithm whereby cryptocurrency traders/users lock some of their crypto assets in a smart contract, for some period of time in order to help secure the network and also participate in the transaction validation of the blockchain network. Then as compensation for locking their crypto assets, they are rewarded, according to the amount of the coin they staked.

Rewards for staking are usually paid out in the same coin that was staked, although some projects might choose to pay out their staking rewards in another coin/token.

Some Staking Terminologies you Need to Know

APY: APY means Annual Percentage Yield. It is the estimated annual rate of returns from staking for a whole year. Here, the effect of compounding interest is also taken into consideration. Note that for any staking pool, as more funds are being staked or locked, the APY reduces.

Principal Staking Amount: This is the number of units of a coin/token you staked or wish to stake in a staking platform. It also determines the amount of staking rewards you will earn at the end of the staking period.

Staking/Lockup Period: This is the period in which the crypto asset you staked will be locked up in a smart contract, mostly specified in days. Most staking platforms have minimum staking/lockup period. For most staking platforms, within these period, you might not have access to crypto asset you staked. Some other staking platforms allow you to unstake your coins any time you wish, sometimes with a penalty.

Major Categories of Staking Platforms

Staking platforms can be classified into the following categories:

Exchanges: Some centralized exchanges now run staking business on their platforms. This creates a means of earning passive income from some idle crypto assets for their users. You simply lockup the coin for some period of time and then earn rewards.

Some top centralized exchanges that offer staking services on their websites apps include: Binance, Coinbase, KuCoin, Kraken, Gemini, Poloniex, Huobi, Okex, etc.

Cold/Private Wallets: In order to earn staking rewards here, you have to keep the staked coins in the same address in a private wallet or cold wallet like Trust wallet, Ledger, Trezor, etc.

Staking-as-a-Service (SaaS) Platforms: These are special centralized platforms dedicated to staking only. These exchanges charge their users a fee for using their staking platforms. SaaS platforms have made it possible for those who are not very conversant with blockchains and crypto trading to benefit from staking. Some of the popular Staking-as-a-Service platforms include: MyCointainer, Stake Capital, etc.

DeFi Staking Platforms: Staking on DeFi protocols is popular known as Liquidity mining. The basis for the trading markets on these DEXs are liquidity pools. These liquidity pools are made up of equal values of token pairs. Since these liquidity pools are public, anyone can provide liquidity to these pools and then earn a share of the swap fee for that trade pair. Some popular DeFi Staking platforms include: Uniswap, SushiSwap, Pancakeswap, Yearn, etc.

You can compare these list of staking platforms in this article at sourceforge.net.

How to Choose a Staking Platform

Don’t be in a hurry to stake your coin in any staking platform. There are some important factors you need to consider before you commit your coins in any staking platform.

- Before you stake your coin any staking platform, take time to read the terms and conditions for staking in that platform. For example, some platforms specify in their staking terms and conditions that the staked coin will first undergo a cooling period before it can be unstaked. Some other platforms specify a minimum staking amount or even staking period, etc.

- Do not be tempted by some excessively high APYs offered by some staking platforms, especially new DeFi protocols. Take time to check their reputations, reviews and ratings in platforms like Reddit and Twitter. This will help reduce your chances of being a victim of rug pull.

- Always stick with staking platforms, such as Maker, Pancakeswap, etc.

- Also, use reliable crypto analytics tools such as Coinmarketcap and Coingecko to check up the details of any PoS-based platform and even stake-as-a-service platforms.

Some Proof of Stake (PoS) Coins you can Stake for Rewards

Here are some popular POS coins you can stake in different staking platforms and then earn passive income via staking rewards.

- ETH 2.o

- BNB

- CAKE

- NEAR

- KCS

- DOT

- SOL

- FLOW

- EGLD

- ADA

- ATOM

- LOOM

- VET

- TOMO

- QTUM

- WAVES

- KAVA

- SRM

- AKT

- RAY

- XTZ

- DG

- DASH

- NEO

- NEBL

- STRAT

- ORN

- WOO

- ICX

- ALGO

- LPT

- YEFI

- PPAY

- AION

- LSK (LISK)

- PIVX

- NAV

- IOST, etc.

Check:

- 20 Helpful Strategies for Making Money in Cryptocurrency Trading

- How to Make Money from Play-to-Earn (P2E) Games

Conclusion

You have learnt how our free staking rewards calculator app works, with its features in this article. Also, you learnt the different categories of staking platforms and some staking terms.

Did you find any section of this article confusing? Drop your questions in the comment section below. Please share this article with your social media friends by clicking a share button below. Don’t forget to subscribe to our blog via email to get notified when we publish new blockchain articles. Enjoy!